25 Things You Can Stop Buying to Save Money

This post may contain affiliate links. Please read how we make money for more information.

Money doesn’t grow on trees (in case you haven’t noticed). And if you’re like most, you work very hard for what you have.

While working hard and earning as much money as possible is a good thing, cutting unnecessary spending is also important. It’s kind of like the yin and yang of money management. You need to do both to maximize your financial potential.

If you are wondering what you can stop buying to save money, the following is a list of 25 things that people who are smart with their finances stopped buying.

The savings can really add up fast. You could save money by just doing one or two of these, or you can do several for massive savings. Your friends will think you’re a financial ninja.

Let’s check them out and discover how to stop buying stuff you don’t need…

Table of Contents

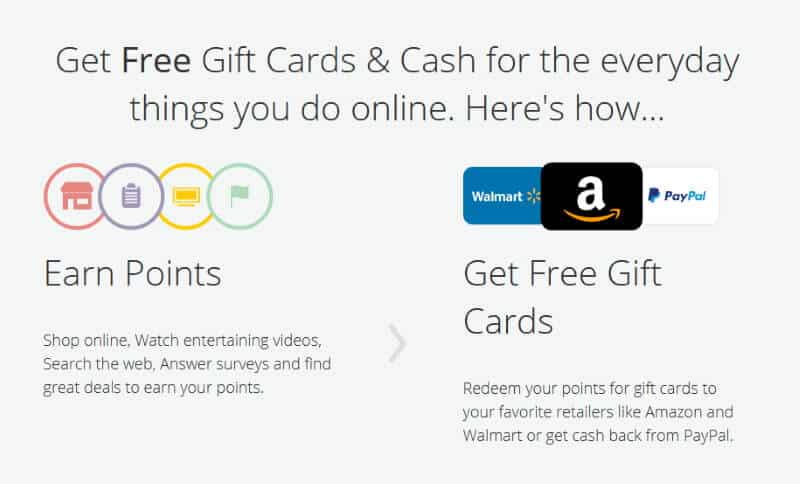

1. Spend Less By Using Free Gift Cards

Did you know you can save money on many of the things you buy just by using Swagbucks and Survey Junkie to earn free gift cards! It’s absolutely true.

Swagbucks lets you earn free gift cards just by doing many of the things you probably already do online like internet searches, watching videos, playing games, and shopping.

What’s not to like about free gift cards?

Survey Junkie lets you earn reward points by completing online surveys in your spare time that can be redeemed for cash via PayPal or gift cards you can use to purchase things.

Many of the gift cards these two sites award can be used to shop at Walmart, Amazon, Target, and other places.

Sign up for Swagbucks today and receive a free $5 bonus!

Sign up for Survey Junkie to get started earning rewards by taking surveys.

2. Ditch Cable TV

Cable television is a major expense that many deal with. And to make matters worse, the cable providers try to force people into buying bundles – television, internet, and phone – all rolled into one big expensive package.

Those bundles are pricey. Depending on the channels and internet options you select, you can easily be looking at $150 – $200 (or more) a month. Ouch!

According to an article in The Motley Fool, Americans spend an average of $64.41 for expanded basic cable a month.

One way you can lower your cable TV expense (if you decide to keep it), is to use Trim. Trim is a free service that negotiates your bills on your behalf to help you get better rates.

Check out Trim to see how it can help you save money on your bills.

You can very easily save a bundle (bundle – get it?) by ditching your cable television subscription and choosing other options. That’s right – cut the cord. Many companies will allow you to subscribe to just an internet service, and you can use your cell phone for calls.

If you live close to a large town or city, you may be able to receive several great channels just by using an antenna. Many over-the-air channels are now transmitted in high definition for a very clear picture.

In addition to using an antenna, you can also purchase a streaming device and subscribe to one of the many popular services that now let you stream channels over the internet. The prices and channels of these services are continually improving, making them a viable alternative to pricey cable packages.

3. Cut Back on Eating Out

Eating out is a favorite pastime of many. After all, who doesn’t enjoy going to a nice restaurant, ordering some great food, and then letting the restaurant deal with all of the cooking and cleanup? It isn’t just about the food. For many, eating out is a form of entertainment. It’s fun!

Even though eating out is a great way to spend an evening, all of that enjoyment does come at a price. Eating out isn’t cheap.

You can very easily save money by eating out less. Or, if you do decide to eat out, choose a more affordable restaurant than what you normally select.

Another option for saving money with restaurants is to be on the lookout for coupons. Many restaurants mail coupons on occasion to those living in their communities to entice people to come and dine with them. Some of these coupons offer some great deals.

Cutting back on eating out doesn’t mean you have to completely eliminate it (although you can do that if you really want to). For example, if you currently eat out every weekend, why not change that to eating out every other weekend? The savings will add up fast.

4. Grocery Shopping Without a Plan

A great way to save money on food is to plan your meals instead of loading up on a bunch of stuff at the grocery store and winging it. By planning your meals, you can know exactly what you’ll need and only buy grocery items that are necessary. This cuts down on waste and helps you save money.

If meal planning is something you’ve never done before and you aren’t sure how to start, you should definitely check out $5 Meal Plan.

This program is only $5 a month, which makes it an incredible bargain. For this price, you receive a meal plan to help you prepare meals for only $2 each. Just think of the savings!

$5 Meal Plan lets you try their service for free for the first 14 days. If you try it and decide it’s not for you, you can cancel the service for any reason.

Check out $5 Meal Plan to see how it can help you save money.

5. Name Brand Grocery Items

Many name brand grocery products are far more expensive than their generic counterparts. And in many cases, the generic or store brands are often just as good as the name brands.

If you aren’t sure of whether your family will go for generic food items over name brands, just run an experiment. You could prepare a meal with generic products, for example, to see if anyone notices the difference. If no one notices, you can then tell them how much you saved by switching to the generic items.

Another way to save a lot of money with groceries is to shop at discount food stores instead of the big chain stores. Grocery Stores like Aldi, Save-A-Lot, Fareway, and others save money by having plain stores without fancy lighting and decorations. They pass the savings on to their shoppers.

6. Gym Memberships

Many people sign up for an annual membership at their local gym with the best of intentions. This is going to be the year they finally get in shape.

And then life gets in the way.

It’s easy to get busy with work, running errands, attending your child’s dance recital or basketball game, and so many other things and completely forget about working out. Sadly, many people who buy expensive gym memberships give up on going to the gym a few weeks or months after signing up – and their membership then goes to waste.

If you are thinking about joining a gym to get back in shape, why not consider taking up a form of exercise that doesn’t require a membership for a while to see if this is something you are going to stick with. You could, for example, take up running or bike riding. You could even do some cardio exercises right in the comfort of your home.

If it looks like you are going to stick with exercising, then spring for the gym membership.

7. New Vehicles

Did you know that new vehicles rapidly go down in value in their first couple of years? Depending on the make and model, they can go down in value by as much as a few hundred dollars a month.

That’s a lot of money to waste just to get the new car smell.

You can very easily save a lot of money by buying gently used vehicles with relatively low miles. Let someone else take the big financial hit from buying new. You can be the smart one by buying their slightly used model when that person decides to trade it in for something new.

In addition to only buying used vehicles, you can also save a lot by buying makes and models that have the best reputations for quality and reliability. Vehicle repairs can often be expensive after a car’s warranty expires.

Take the time to research brand quality and reputation before you buy a vehicle. The right brand could save you thousands in unnecessary repairs down the road (down the road – get it?) and also possibly last longer.

8. Fancy Things to Impress People

Many people spend a lot of money to buy expensive things just to impress others. They may buy expensive luxury vehicles, pricey name brand clothes, big houses, and other things.

The sad reality of buying expensive things to impress people is that most really don’t care. This is especially true if you live in a big city where few people even know who you are. Money doesn’t buy happiness.

Instead of being impressed by your expensive vehicle while you are waiting at a stoplight, other drivers are most likely thinking about other things – like what they are going to have for dinner or things they need to do. Most drivers couldn’t care less about your fancy ride.

You can potentially save thousands (and possibly even tens of thousands) by keeping it real with normal vehicles, clothes, and other items.

9. New Stuff

A great way to save big is by shopping for used items whenever possible instead of buying new.

Many people buy new items and then later sell them for a variety of reasons. Maybe someone no longer needs a drill press after giving up on his woodworking hobby. Or perhaps another person recently moved and needs a bigger TV for her new living room.

Whatever the case, you may be able to save big on many different items by purchasing them used instead of new. And if you only select those items that are gently used, they may have most of their useful life in front of them.

Thanks to the internet, shopping for used items is now very easy. There are several great places to shop including Facebook Marketplace, OfferUp, Craigslist, and others. And if you enjoy shopping in person, you can check thrift stores, consignment stores, flea markets, yard sales, and other places.

One of the great things about buying used items is that many people don’t know the value of their stuff. When they list items for sale, they may list them for much less than they are actually worth. If you can identify items that are undervalued, you can snag some amazing deals.

Thrift stores are great places to shop for used clothing items. Many people donate name brand items that are in great shape all the time. Thrift stores then sell these items for just a small fraction of their original value.

10. Expensive Entertainment

Expensive entertainment is another thing that many people can stop buying to save money.

Do you enjoy going out a lot of the weekends? There’s certainly nothing wrong with that, but entertainment can be expensive. Just going to the movies can easily cost $40 – $50 for two people if you also buy snacks and drinks.

One way you can save money on entertainment is to have an occasional no spend weekend. Just stay home instead. Who says you have to go out all the time? Many, in fact, find relaxing at home to be just as enjoyable as an evening on the town.

There are many things you can do at home. Watching movies is a popular option. You could also catch up on your reading or enjoy a hobby. It doesn’t take a lot of creativity to come up with interesting and engaging things to do that are very inexpensive (or free).

11. Prepared Foods

When you go grocery shopping, do you buy a lot of food items that have already been prepared? I’m talking about things like cookies, cakes, packaged meals that only require you to heat them up, and similar items?

Prepared foods are almost always a lot more expensive than their ingredients. You pay extra for the work that went into preparing the items you purchased. You can potentially save a lot of money by buying the ingredients for whatever it is you want to eat and preparing it yourself.

There are some advantages to cooking things yourself instead of letting someone else do the cooking for you. For example, by preparing your own meals, you can be sure of what’s in them. Because you are in control, you never have to worry about an ingredient you might be allergic to or using an additive that is unhealthy.

Cooking your own meals is also best for those who are on special diets. This lets you know for sure that your meal doesn’t contain something you’re not supposed to eat – like sugar, gluten, or something else.

12. Items That Aren’t on Sale

It isn’t possible to buy used items all the time. There are some times when it does make sense to buy new. But if you make a habit of buying new items when they aren’t on sale, you can very easily overspend.

It’s always a good practice to be on the lookout for sales. Many stores send flyers in the mail alerting shoppers to upcoming sales they are having. Whenever there’s going to be a sale at a store you shop at, be sure to see if there are any items you need.

Also, if you need an item and you aren’t sure if there are any sales currently underway, call around to stores in your area to see if they have any current promotions. You never know unless you ask.

13. Bottled Water

Water is, quite possibly, one of the most overpriced things that people buy. If you buy bottled water on a regular basis, you may be able to save a lot of money by ditching the single-use bottles and switching to a refillable water bottle. Water bottles are very inexpensive and can be easily washed.

If you need bottled water for an event, consider purchasing a large water jug with a spigot and some disposable cups. The water jug can be cleaned and used again, and the cups are very inexpensive.

14. Fancy Coffee

Do you enjoy those fancy coffee drinks that are sold at coffee shops – the ones that go for $5 each? If you drink those on a regular basis, you can very easily save a lot of money by skipping those in favor of coffee you make yourself.

If you enjoy drinking coffee throughout the day, as many people do, why not brew some coffee at home and take it with you to work in a thermos? It’ll stay hot for a long time, and it’ll be a lot cheaper than buying ready-made coffee while you are on the go.

In addition to saving money by drinking coffee you made yourself, you may also be able to slim down a bit. Many of those fancy coffee drinks sold at coffee shops are loaded with sugar.

15. Impulse Purchases

Do you occasionally purchase things that catch your eye at the store – things you weren’t planning on buying but suddenly decided that you couldn’t live without? These are known as impulse buys, and they can end up costing you a lot if you make unplanned purchases on a regular basis.

One way you can save money on impulse buys is to force yourself to wait a period of time before buying whatever it is that caught your eye. The amount of time is totally up to you. It could be a few days, a week, or even a month.

The purpose of forcing yourself to wait is to give yourself time to think about the purchase. You can take the time to decide whether it’s something you really need. And if so, perhaps you could find a better deal on it somewhere else – or buy it used for even bigger savings.

16. Labor Costs

If you’ve ever had to call someone to repair your HVAC system, an appliance, a plumbing issue, or something else, then you already know that labor is very expensive. Depending on your skill with DIY projects and repairs, you may be able to save a lot of money by doing these things yourself instead of hiring someone.

These days, if you don’t know how to fix something, all you have to do is look it up online or on YouTube. Thanks to the internet, a vast library of information is just a few mouse clicks away that can tell you how to fix a leaky faucet, build a patio, seal your driveway, or do something else.

There are some times, of course, when it does make sense to call a professional. You always want to call a pro when it involves something dangerous, like the electrical wiring in your home. Also, there are some code restrictions that may require the use of a professional. It just depends on where you live. Be sure to contact your local authorities to find out if you aren’t sure.

17. Cell Phones

Cell phone plans are a major expense for many. The interesting thing about cell phones is the companies that provide cell phone service are in fierce competition with each other. That means the plans they offer keep getting better and better.

If you haven’t updated your cell phone plan in a few years, you should definitely take the time to compare plans from competing companies to see what they offer. You might be surprised by how much things have changed and how much money you can save by switching to a new plan.

When you shop for different plans, don’t just check with the big name carriers. Also check with the prepaid providers. These days, the service offered by many of the prepaid companies is just as good as the major carriers. In fact, many prepaid companies use the same cell phone towers as the big companies. Many of them also offer the same phones. The only difference is in the price.

18. Expensive Vacations

Taking a well-earned vacation is a great way to recharge your batteries. For many, however, this means taking expensive vacations to exotic destinations.

These vacations can cost thousands of dollars. Airfare alone can be several thousand dollars for two people (depending on your destination), and when you arrive you also have to pay for a hotel, meals, and incidental expenses.

There’s certainly nothing wrong with traveling the world and seeing new things. It’s fun and exciting! But if it’s something you like to do every year, it can really drain your bank account.

Instead of taking vacations that require you to purchase airfare, why not take a local vacation instead? You could pick a destination that is a relatively short drive and stay a few places at affordable lodging. You could even pack enough food for your breakfasts, lunches, and snacks and enjoy a nice meal out of the evenings.

Another option is to have an occasional stay-cation. Just stay home. The savings will be substantial, and you won’t have to worry about packing, unpacking, airport hassles, driving long distances, and dealing with other travel headaches. You can just relax in the comfort of your home and enjoy doing absolutely nothing.

19. Alcohol and Tobacco

A major expense that many stop buying to save money is alcohol and tobacco. If you use these vices on a regular basis, you undoubtedly know how expensive they can be.

According to the Centers for Disease Control and Prevention (CDC), the average cost of a pack of cigarettes is $6.28. If you smoke just one pack of cigarettes a day, that comes to almost $3,000 a year.

That’s a lot of money!

And that’s just for cigarettes. You can easily spend just as much if you drink beer, wine, and liquor on a regular basis.

In addition to saving big by quitting alcohol and tobacco, you may also be able to improve your health. Alcohol and tobacco aren’t good for you, and it’s never too late to quit.

20. Expensive Clothes

Clothing can be pricey if you insist on expensive brands and don’t shop when things are on sale. But you can still dress well without spending a lot of money. The key is to shop for used clothes.

Thrift stores are treasure troves of gently used apparel. Many people donate items after they’ve either gained or lost weight and they can no longer wear their former fashions. You can take advantage of this to pick up some great items for very little money.

The great thing about shopping at thrift stores is that most of them only accept donated items that are still in good condition – no junk allowed.

In addition to shopping at thrift stores for clothing items, it’s also possible to find great deals at consignment stores, yard sales, and even online at Craigslist, Facebook Marketplace, and others.

And if you prefer new, it’s still possible to snag some great deals if you only shop when things are on sale.

21. Magazine Subscriptions

Magazine subscriptions typically aren’t expensive, but the savings can really add up if you cancel subscriptions to several magazines. Take the time to evaluate whether the magazines you receive are actually being read in your household. If they aren’t, then consider canceling.

An alternative to subscribing to magazines is to visit your library once a month to catch up on your reading. Most libraries subscribe to the most popular magazines. You can read the ones they have and then subscribe to the ones they don’t have that you like reading.

22. Books

Do you have a collection of books you’ve purchased over the years? If so, you probably already know how expensive the print version of the written word is. Many new books are $20 – $30 each. That’s a lot to spend on books you may only read once.

You can easily save money on books by checking them out of your local library instead. Libraries are incredible resources that are often underappreciated. In addition to books, many libraries also have movies, free internet, magazines, and other things. Some even offer free events or author speaking sessions.

But what if your library doesn’t have a book you need or want?

Many libraries participate in inter-library loan. This means if your library doesn’t have a book you need, you can request that they obtain it from another library. Some libraries do this for free, but others may charge a small fee for the service.

Many libraries also accept recommendations for new book purchases. If a new book is coming out that you would like to read, your library may purchase it to be a part of its collection if you make a request. No guarantees, of course. It never hurts to ask.

23. Junk Food and Drinks

Junk food, soft drinks, and energy drinks are a major expense for many, although most don’t even realize how much they spend on these items. Although processed snack items may taste great, they are usually not good for you.

Instead of drinking sugary drinks, why not drink water instead? If you use a refillable water bottle and drink tap water, you can have an endless supply of it for next to nothing.

Instead of snacking on chips, pretzels, donuts, sugary snacks, and other processed foods, consider fresh fruits and vegetables as an alternative. Both your body and your wallet will thank you.

24. Recreational Vehicles

This is a big one.

Recreational vehicles are vehicles that are bought just for fun. They include motorcycles, campers, jet skis, boats, and airplanes.

If you can resist the temptation of buying a recreational vehicle that you don’t need, you can potentially save thousands – and possibly tens of thousands. And if you need a recreational vehicle for a weekend excursion, just rent one. Many marinas have boats for rent, for example. And even if you’re a pilot, many airports have airplanes that they rent, too.

25. Expensive Colleges and Universities

I saved the best for last – pricey colleges and universities.

In case you haven’t noticed, the price of attending many colleges and universities is at an all-time high. It’s not uncommon at some schools for students to graduate with six-figures in student loan debt. And to make matters worse, the starting salaries for many majors is barely enough to allow graduates to repay their student loans and afford their living expenses.

Many people think that attending one of these fancy pants schools is their ticket to a lucrative career, but it doesn’t always work that way. While there are some careers where the reputation of the school you attended does matters – like being an attorney or college professor – it really doesn’t matter for most careers. For most jobs, having a college degree is just a “check the box” thing on your application.

You can potentially save big by shopping around for an affordable state school. You can save even more by earning your degree online and living at home while you work either full or part-time.

Don’t forget community colleges. You can very easily earn the first two years of a bachelor’s degree at one of these schools for just a fraction of the cost of other schools. And there are also many two-year degree programs with starting salaries that are competitive with many four-year degrees.

Simple Savings

Did you realize there were so many ways you can save money by not buying things you don’t need? The savings can really add up fast once you cut one or more of these things out of your life. And after you’ve gone a few weeks or months without them, you may not even miss them.

People buy things they don’t need all the time. Sometimes they buy and keep stuff for the sake of hoarding. Eliminating unnecessary expenses from your life isn’t just about saving money. It’s also about simplifying your life.